What was your Childhood Net Worth?

What was your Childhood Net Worth?

What was your Childhood Net Worth?

January 24th, 2024 [3 min. read]

By Drew W. Boyer, CFP®

Baseball cards, comic books, and cassettes.

Every holiday we get our family together, my mom says, "she always knew I'd end up doing something with money." So true. I can vividly remember back in my childhood when my net worth was sports cards, comic books, and my music collection. I felt richer every time I was able to save up, or trade, and add more to my collection. To this day, I still have them all stored in my college-era black chest box along with all my other adolescent memories for my kids to look through. But alas, too many cards and comics were made and now their value is maybe what was printed on the cover or card pack. Perhaps they can make a comeback someday, but cassette tapes?

Fuhgeddaboudit.

Pause for a moment and reflect: what did you collect as a kid? I bet it'll bring back some good memories.

Nowadays it's cash, retirement, and education accounts, but it just doesn't carry the same weight. You can't hold them, you can't touch them, and let's face it- reading an investment statement just doesn't give you the same satisfaction as a Spawn or Death of Superman comic book storyline.

Sometime in middle school, I was introduced to baseball cards and comics. I had just started making some money from odds and ends jobs at my dad's vet clinic in order to save-up and curate my collection. I can remember going weekly to the store to see what had come in and if any deals were to be had. My brothers and I would then go home with our new plunder and trading would commence. This is how I learned the art of finance.

Nerd alert: I could've cared less about baseball, but man oh man I was able to memorize the statistics on the back. My favorite? If you can hit one out of three, you've got a great chance of making it into Cooperstown.

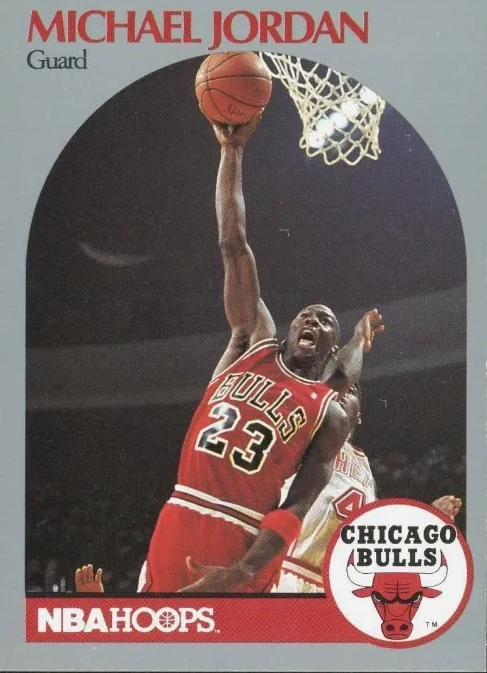

Besides the stats, what got me hooked were how much rookie cards for Michael Jordan, Joe Montana, or Ken Griffey Jr. were valued at. People had originally purchased these in the packs of cards; remember Topp's and Upper Deck? The feeling of opening a fresh pack and seeing what was inside is close to the dopamine-rush of scratching an almost-winning lottery ticket, but I never got any good cards that way.

I got all my best cards through saving up, purchasing other tradable cards, (i.e., aficionado value). Once I had something others wanted, I could then trade-up for better cards that I really wanted. There was nothing better than making a lopsided trade with my brothers. They grumbled every time, but that didn't ever stop us from our weekly tradition.

Fast forward to toda y and want to know how to get ahead? You have to save first, purchase assets others want, and then either save them or trade them. Set-up an automated savings program and watch your balance go higher from your contributions, compounded earnings, interest, and dividends.

y and want to know how to get ahead? You have to save first, purchase assets others want, and then either save them or trade them. Set-up an automated savings program and watch your balance go higher from your contributions, compounded earnings, interest, and dividends.

It's really that simple. Every time you add to it, your net worth goes up.

But perhaps more importantly, sometimes things' intrinsic value doesn't go up, but are worth even more to you. Like your childhood memories or my cards. They have no value to others except to you.

What do you do that has no intrinsic value, but provides memories?

Make sure you do more of that. It's important to build your wealth, but never forget about building your life in the process. That's the true investment in memories.